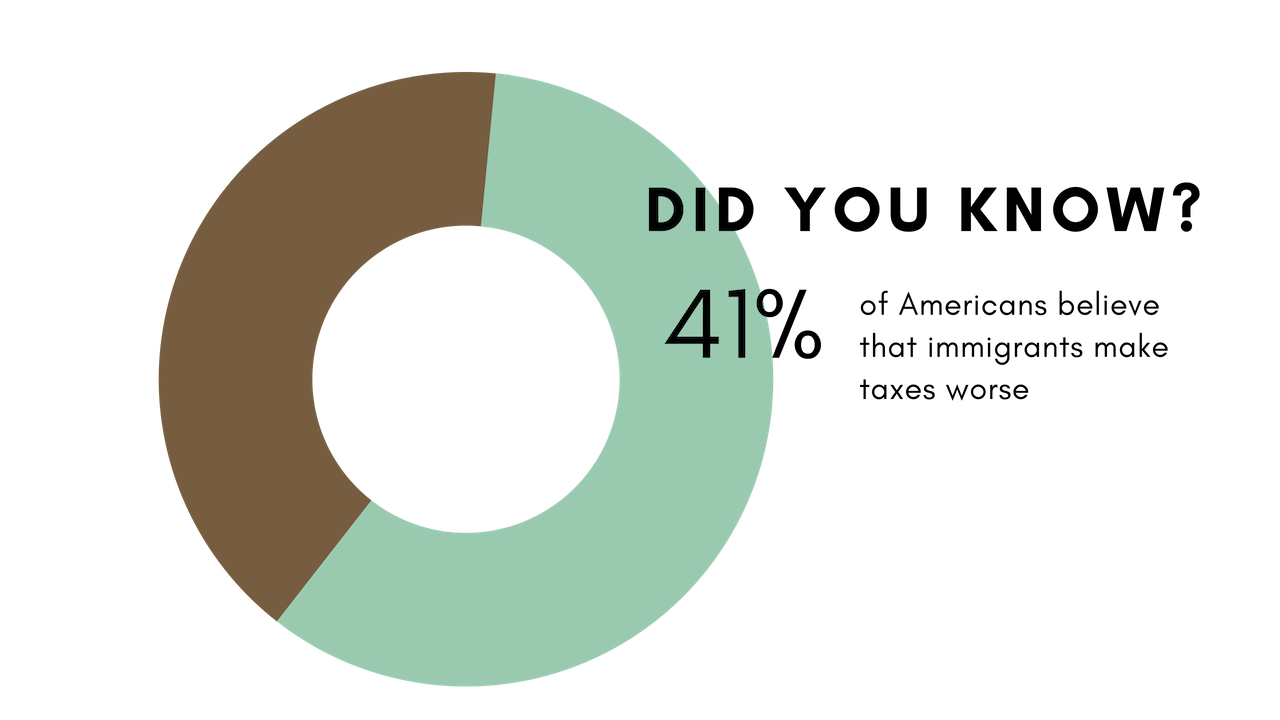

Lots of people believe that immigrants don't pay taxes but, surprisingly, that's not true! Many immigrants living in the United States—often even those living here illegally—pay taxes.

Residents

If an immigrant is a resident, like someone with a Green Card, they’re usually taxed just like a U.S. citizen. [2] All of their income, whether it’s made in the U.S. or outside of the U.S., is taxed.

Non-Residents

Non-residents, on the other hand, only get taxed on their income made in the U.S. or any money that they make from a U.S. trade or business. [3]

Immigrants Living Illegally in the U.S.

Immigrants living illegally can pay taxes too! All they need is an ITIN number. This number takes the place of a social security number on tax forms and allows many types of immigrants to file taxes in the United States. [4]

If an immigrant is a resident, like someone with a Green Card, they’re usually taxed just like a U.S. citizen. [2] All of their income, whether it’s made in the U.S. or outside of the U.S., is taxed.

Non-Residents

Non-residents, on the other hand, only get taxed on their income made in the U.S. or any money that they make from a U.S. trade or business. [3]

Immigrants Living Illegally in the U.S.

Immigrants living illegally can pay taxes too! All they need is an ITIN number. This number takes the place of a social security number on tax forms and allows many types of immigrants to file taxes in the United States. [4]

Unfortunately, it’s hard to say exactly how many illegal immigrant actually do file taxes since they don’t have to identify their citizenship status on their tax return.

However, researchers can (and do!) make educated guesses. [5]

However, researchers can (and do!) make educated guesses. [5]

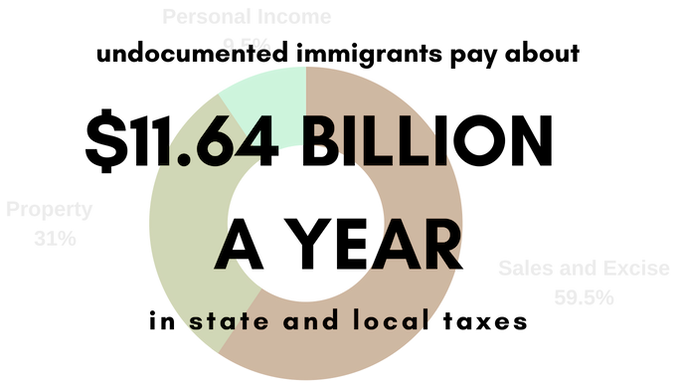

So even though the data isn’t 100% accurate,

it’s clear that illegal immigrants pay taxes in various forms.

Sales & Excise Tax

Just like everyone else, illegal immigrants pay taxes on the things and services that they buy. Whether purchasing clothes at the mall or paying their utility bill, illegal immigrants have to pay these types of taxes just to live a regular American life. [7]

Property Taxes

At times it can be challenging to make it happen, but undocumented immigrants can purchase homes. If they own their own home they have to pay property taxes like any other American home owner. If they don’t own but rent, they indirectly pay property taxes that their landlords factor into their monthly rent. [8]

State Income Taxes

About 50% of illegal immigrants file income tax returns using an ITIN number. What about the other 50%? The good news is that they likely pay income tax too! Despite what we might assume about the kind of under the table jobs that illegal immigrants employ, many undocumented immigrants get regular checks from their employers with income tax already deducted from the total. [9]

it’s clear that illegal immigrants pay taxes in various forms.

Sales & Excise Tax

Just like everyone else, illegal immigrants pay taxes on the things and services that they buy. Whether purchasing clothes at the mall or paying their utility bill, illegal immigrants have to pay these types of taxes just to live a regular American life. [7]

Property Taxes

At times it can be challenging to make it happen, but undocumented immigrants can purchase homes. If they own their own home they have to pay property taxes like any other American home owner. If they don’t own but rent, they indirectly pay property taxes that their landlords factor into their monthly rent. [8]

State Income Taxes

About 50% of illegal immigrants file income tax returns using an ITIN number. What about the other 50%? The good news is that they likely pay income tax too! Despite what we might assume about the kind of under the table jobs that illegal immigrants employ, many undocumented immigrants get regular checks from their employers with income tax already deducted from the total. [9]

But, many people in the U.S. want all illegal immigrants to pay taxes.

This is reasonable and, in fact, it makes a lot of sense too. Illegal immigrants live in our country and use many of our tax-funded services. Why shouldn’t they pay taxes?

There are many possible reasons why illegal immigrants might not pay taxes.

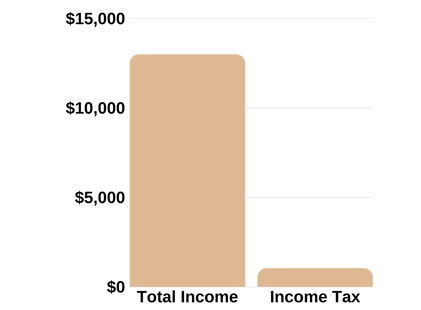

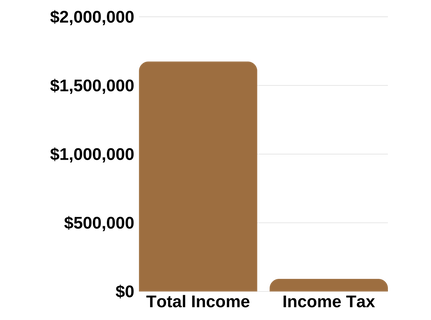

It’s possible that they think they cannot file taxes because of their illegal status. It’s also possible that they fear that they could be deported if they file taxes. They might also be discouraged from filing taxes because of the high tax rates for illegal immigrants. The average illegal immigrant pays 8% of their income in state and local taxes [11] but only makes $12,991 annually. [12] The top 1% of American income earners only pay 5.4% [13] and make $1,672,919 on average annually. [14]

There are many possible reasons why illegal immigrants might not pay taxes.

It’s possible that they think they cannot file taxes because of their illegal status. It’s also possible that they fear that they could be deported if they file taxes. They might also be discouraged from filing taxes because of the high tax rates for illegal immigrants. The average illegal immigrant pays 8% of their income in state and local taxes [11] but only makes $12,991 annually. [12] The top 1% of American income earners only pay 5.4% [13] and make $1,672,919 on average annually. [14]

Illegal Immigrants |

American 1% |

On the plus side, there are ways to encourage illegal immigrants to pay taxes.

|

Driver’s License Incentive Some states offer driver’s licenses to illegal immigrants without much of a fuss. Both Delaware and Maryland, however, only allow illegals to go through the licensing process after they have filed at least 2 years of income taxes. Programs like this, either directly or indirectly, incentivize illegal immigrants to file taxes. [15] Residency Incentive If an illegal immigrant is lucky enough to be able to apply for a Green Card they are also more likely to file taxes. The Border Security, Economic Opportunity, and Immigration Modernization Act lists payment of taxes as an eligibility requirement. [16] Most illegal immigrants hope to one day become permanent residents and if properly informed would likely file taxes if they met eligibility requirements. Health Insurance Incentive Although currently most illegal immigrants are unable to apply for health insurance, it is a good alternative for tax filing incentives. Health insurance is a coveted benefit that many undocumented immigrants desire. By making it available to them after filing taxes for a certain period of time, we can increase taxable income by increasing the number of illegals who file taxes. |

Are you looking for more sources of information on the immigration/taxation debate? Explore the sources below to find out more! Or click here to learn about other migration myths.

Recommended Reads for More Info:

- Institute on Taxation and Economic Policy (ITEP) Report. This is a non-partisan source with lots of information although it does use some more academic language and jargon to get its point across.

- For further reading on ITINS: https://taxpayeradvocate.irs.gov/Media/Default/Documents/2017-ARC/ARC17_Volume1_MSP_16_ITINS.pdf

- Institute on Taxation and Economic Policy (ITEP) Report. This is a non-partisan source with lots of information although it does use some more academic language and jargon to get its point across.

- For further reading on ITINS: https://taxpayeradvocate.irs.gov/Media/Default/Documents/2017-ARC/ARC17_Volume1_MSP_16_ITINS.pdf

Sources Referenced on this Page:

[1] Opening Graphic: https://news.gallup.com/poll/1660/immigration.aspx This data is from 2017, See the taxes section of this question: "For each of the following areas, please say whether immigrants to the United States are making the situation in the country better or worse, or not having much effect. How about -- [RANDOM ORDER]?”

[2] https://www.irs.gov/publications/p519 See introduction; and "4. How income of aliens is taxed", "Resident Aliens" section

[3] https://www.irs.gov/publications/p519 See introduction; and "4. How income of aliens is taxed", "Introduction" section

[4] https://www.americanimmigrationcouncil.org/sites/default/files/research/the_facts_about_the_individual_tax_identification_number.pdf

[5] https://itep.org/wp-content/uploads/immigration2016.pdf; This is an example of a study that uses statistical analysis to estimate the contributions of undocumented migrants from the Institute on Taxation and Economic Policy (ITEP). This is the most non-partisan tax source that we could find. The study does have some limitations. See the "Methodology" section of the report for more info.

[6] Second Graphic: https://itep.org/wp-content/uploads/immigration2016.pdf; see “Undocumented Immigrants Pay State and Local Taxes: Current Contributions” paragraph two

[7] https://itep.org/wp-content/uploads/immigration2016.pdf; see Undocumented Immigrants Pay State and Local Taxes: Current Contributions

[8] https://itep.org/wp-content/uploads/immigration2016.pdf; see Undocumented Immigrants Pay State and Local Taxes: Current Contributions

[9] https://itep.org/wp-content/uploads/immigration2016.pdf; see Undocumented Immigrants Pay State and Local Taxes: Current Contributions

[10] https://itep.org/wp-content/uploads/immigration2016.pdf; see "Key Findings" section

[12] https://cis.org/Immigrants-United-States-Profile-Americas-ForeignBorn-Population-0; "Illegal’s Household Income" section, table 41. Analysis comes from 2010-11 population survey data.

[13] https://itep.org/wp-content/uploads/immigration2016.pdf; page 1

[14] https://www.irs.gov/statistics/soi-tax-stats-individual-time-series-statistical-tables#_grp8; 'Individual Income Tax Returns with Positive "1979 Income Concept" Income Excluding Dependents' section. Data is from 2011 to match illegal immigrant income data (from 2010-2011).

[15] http://www.mva.maryland.gov/announcements/non-compliant-driver-license-ID-cards.htm; https://www.dmv.de.gov/services/driver_services/drivers_license/dpc/index.shtml#horizontalTab2

[16] https://www.congress.gov/bill/113th-congress/senate-bill/744; "S.744 - Border Security, Economic Opportunity, and Immigration Modernization Act (Sec. 2102): Authorizes the Secretary to adjust the status of an RPI alien to that of an alien lawfully admitted for permanent residence if such person meets specified eligibility requirements, including: (1) continuous physical presence, (2) evidence of employment or full-time education, (3) English language skills, (4) payment of taxes, and (5) security and law enforcement clearances."

[1] Opening Graphic: https://news.gallup.com/poll/1660/immigration.aspx This data is from 2017, See the taxes section of this question: "For each of the following areas, please say whether immigrants to the United States are making the situation in the country better or worse, or not having much effect. How about -- [RANDOM ORDER]?”

[2] https://www.irs.gov/publications/p519 See introduction; and "4. How income of aliens is taxed", "Resident Aliens" section

[3] https://www.irs.gov/publications/p519 See introduction; and "4. How income of aliens is taxed", "Introduction" section

[4] https://www.americanimmigrationcouncil.org/sites/default/files/research/the_facts_about_the_individual_tax_identification_number.pdf

[5] https://itep.org/wp-content/uploads/immigration2016.pdf; This is an example of a study that uses statistical analysis to estimate the contributions of undocumented migrants from the Institute on Taxation and Economic Policy (ITEP). This is the most non-partisan tax source that we could find. The study does have some limitations. See the "Methodology" section of the report for more info.

[6] Second Graphic: https://itep.org/wp-content/uploads/immigration2016.pdf; see “Undocumented Immigrants Pay State and Local Taxes: Current Contributions” paragraph two

[7] https://itep.org/wp-content/uploads/immigration2016.pdf; see Undocumented Immigrants Pay State and Local Taxes: Current Contributions

[8] https://itep.org/wp-content/uploads/immigration2016.pdf; see Undocumented Immigrants Pay State and Local Taxes: Current Contributions

[9] https://itep.org/wp-content/uploads/immigration2016.pdf; see Undocumented Immigrants Pay State and Local Taxes: Current Contributions

[10] https://itep.org/wp-content/uploads/immigration2016.pdf; see "Key Findings" section

[12] https://cis.org/Immigrants-United-States-Profile-Americas-ForeignBorn-Population-0; "Illegal’s Household Income" section, table 41. Analysis comes from 2010-11 population survey data.

[13] https://itep.org/wp-content/uploads/immigration2016.pdf; page 1

[14] https://www.irs.gov/statistics/soi-tax-stats-individual-time-series-statistical-tables#_grp8; 'Individual Income Tax Returns with Positive "1979 Income Concept" Income Excluding Dependents' section. Data is from 2011 to match illegal immigrant income data (from 2010-2011).

[15] http://www.mva.maryland.gov/announcements/non-compliant-driver-license-ID-cards.htm; https://www.dmv.de.gov/services/driver_services/drivers_license/dpc/index.shtml#horizontalTab2

[16] https://www.congress.gov/bill/113th-congress/senate-bill/744; "S.744 - Border Security, Economic Opportunity, and Immigration Modernization Act (Sec. 2102): Authorizes the Secretary to adjust the status of an RPI alien to that of an alien lawfully admitted for permanent residence if such person meets specified eligibility requirements, including: (1) continuous physical presence, (2) evidence of employment or full-time education, (3) English language skills, (4) payment of taxes, and (5) security and law enforcement clearances."

Partisan Sources:

Want to do your own research and hear from both sides of the debate? The sources used on this page are all non-partisan. That means that they don't associate themselves with any political parties or ideologies. The sources listed below are more biased in their interpretation of the data. However, they still can provide a useful perspective on the debate.

LEFT:

- American Immigration Council https://www.americanimmigrationcouncil.org/sites/default/files/research/adding_up_the_billions_in_tax_dollars_paid_by_undocumented_immigrants.pdf; https://www.americanimmigrationcouncil.org/sites/default/files/research/Tax_Contributions_by_Unauthorized_Immigrants_041811.pdf

- Immigration Policy Center (their research arm) http://www.immigrationresearch-info.org/system/files/ItsTax_Time.pdf

RIGHT:

- Center for Immigration Studies

https://cis.org/sites/cis.org/files/articles/2001/mexico/mexico.pdf; https://cis.org/Child-Tax-Credits-Illegal-Immigrants

Want to do your own research and hear from both sides of the debate? The sources used on this page are all non-partisan. That means that they don't associate themselves with any political parties or ideologies. The sources listed below are more biased in their interpretation of the data. However, they still can provide a useful perspective on the debate.

LEFT:

- American Immigration Council https://www.americanimmigrationcouncil.org/sites/default/files/research/adding_up_the_billions_in_tax_dollars_paid_by_undocumented_immigrants.pdf; https://www.americanimmigrationcouncil.org/sites/default/files/research/Tax_Contributions_by_Unauthorized_Immigrants_041811.pdf

- Immigration Policy Center (their research arm) http://www.immigrationresearch-info.org/system/files/ItsTax_Time.pdf

RIGHT:

- Center for Immigration Studies

https://cis.org/sites/cis.org/files/articles/2001/mexico/mexico.pdf; https://cis.org/Child-Tax-Credits-Illegal-Immigrants